Our Platform

Free (Yes, Free)

What People Are Saying

“GivingFund allows us to have a positive impact in a way that feels familiar: engaging with a central tool and system that helps us understand our goals, allocating our giving based on the different types of impact we want to have, and tracking it like we would other investments and budgets. Plus, it’s an accountability tool to directly track if we’re putting our money where our mouths—and hearts—are.”

Step 1: Develop a Strategy

Many of our users are either new to giving, or haven’t spent much time really reflecting on how their values and lived experience relate to the donations they make.

Not sure where to start? That's ok. When you open a GivingFund account, we walk you through a giving style personality quizzes and user profiles to inspire you and help you create goals.

Step 2: Fund Your Account and Start Giving

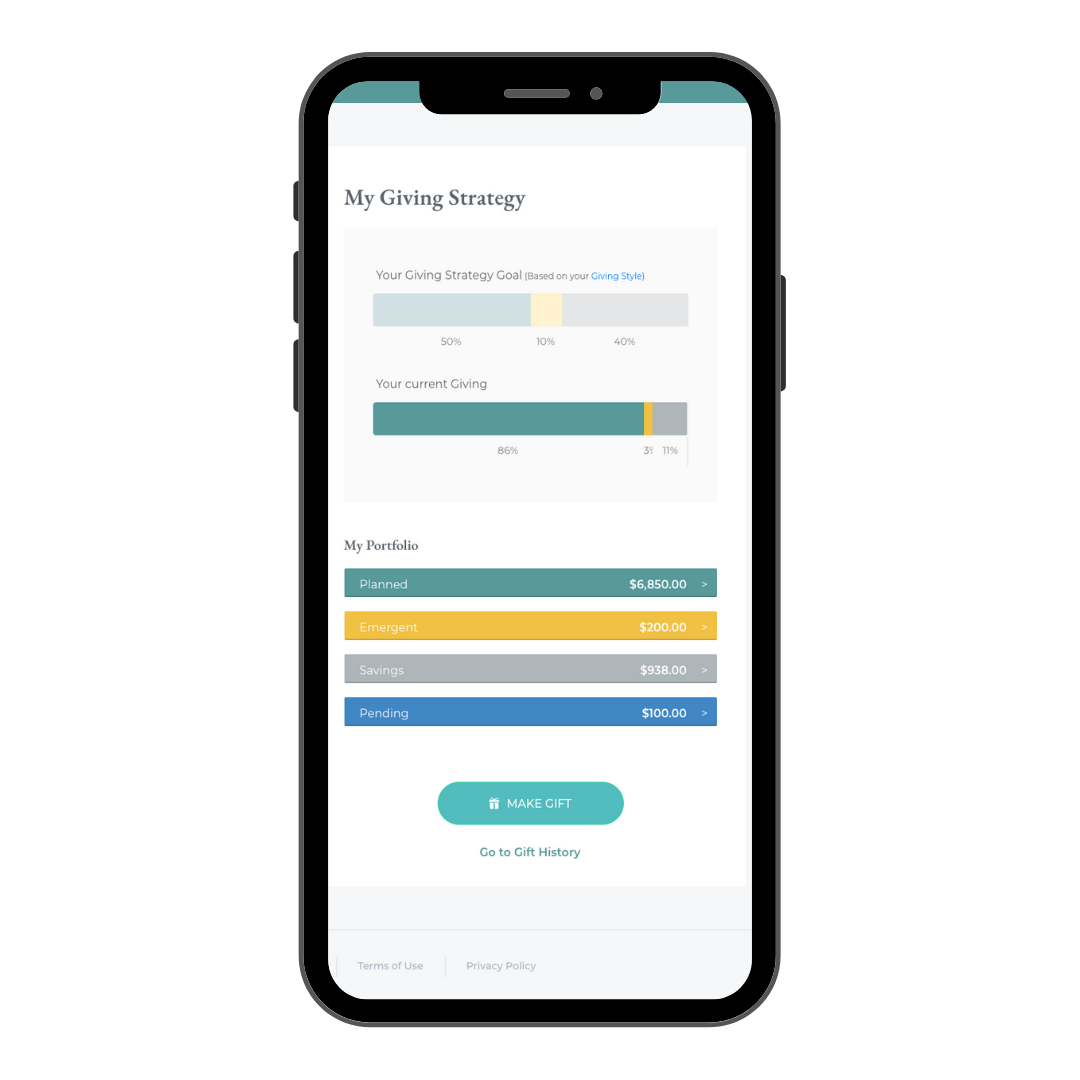

Based on your peer group, your salary, and your philanthropy goals, we help you define a budget for your philanthropic giving. After entering in your payment information, you seed your account with an initial payment, and then automate regular monthly payments into your GivingFund going forward.

The money in your GivingFund is earmarked for philanthropy, so you can keep yourself accountable to your goal. Think about it like an impact bank account.

-

Monthly Donations

As soon as you set up your GivingFund, you can enter in specific nonprofits that you want to support each month. GivingFund automates donations to these organizations each month from your fund. You can change these organizations at anytime, as your passions evolve.

-

One Time Gifts

When a friend is raising money for a cause or when a natural disaster happens, log in to your GivingFund to see how much you have set aside to give. Then, move money from your fund to the nonprofit of choice. Using your fund allows you to track all your ad-hoc gifts centrally.

-

Savings and Impact Investments

Set some of your GivingFund aside to save up for a larger future gift. The best part? We’ll put this capital to work in impact investments that help create economic justice - like loans to local businesses or affordable housing projects. When you’re ready to give, your Fund will have twice the impact!

Step 3: Track & Analyze

Using the GivingFund portal, you can view all of the gifts you've made this year in one place. See what portion of your philanthropy you're spending on different causes, and reflect on how they map to your personal passions and unique story. You can increase or decrease your monthly giving, your total philanthropy goal, or reallocate across organizations.

At the end of the tax year, GivingFund issues you a single tax receipt for all of the money you've put into your fund that year.

Join Us

Free. No minimums, and no transaction costs. (We explain how we keep GivingFund free in our FAQs)